Loan Resources

Since 2018, Credit9 has provided over $185 million in personal loans to over 14,000 of our customers, and we’re confident we can help you too. With a Credit9 Loan, you can eliminate credit card debt and enjoy a single, fixed, and affordable monthly payment.

In the sections below, you’ll discover many helpful articles about how to use a debt consolidation loan to pay off your credit cards, manage debt, and improve your credit score along with other financial topics that may be of interest to you.

What Is Student Loan Forgiveness? (What You Need To Know)

Posted on Jan 30, 2023 by Melissa Cook

Are you struggling to make your student loan payments? Are you feeling overwhelmed and stressed out? If so, you might be eligible for student loan forgiveness. Below, we’ll cover how to find out if you are eligible and the steps you need to take to apply for forgiveness. Don’t let...

Read More

How To Set Up Your Budget (An Easy-To-Follow-Process)

Posted on Jan 17, 2023 by Aaron Sarentino

Setting up a budget can be a daunting task, but it can be simplified when you follow the right process. It is important to take the time to create an effective budget plan that will help you make smarter financial decisions. Here are some tips on how to get started…...

Read More

How To Get A Loan If You Have Bad Credit

Posted on Jan 05, 2023 by Melissa Cook

A debt consolidation loan is a type of loan that can help you consolidate multiple lines of debt into one manageable loan. Debt consolidation loans can be an effective way to reduce the number of monthly payments you make and may save you money in the long run. However, getting...

Read More

4 Ways To Build Credit Fast

Posted on Jan 05, 2023 by Aaron Sarentino

Building credit is necessary to establish yourself as a responsible, independent adult. Maintaining good credit can affect your ability to get approved for future loans or mortgages, and it can help you save money on interest rates and loan fees. Unfortunately, building credit can be challenging, especially if you’re trying...

Read More

Is Personal Loan Interest Tax Deductible? (Here’s What To Know)

Posted on Jan 05, 2023 by Melissa Cook

Personal loans are a popular choice for people who need cash unexpectedly. But if you’re considering taking out a personal loan for yourself, it’s worth understanding the tax implications before committing to any big financial decisions. Are Personal Loans Tax Deductible? No. Typically, personal loans are not considered tax-deductible. This...

Read More

What Is A Personal Loan? Understanding Rates, Credit, And More…

Posted on Jan 05, 2023 by Melissa Cook

A personal loan is a type of loan that can be used for any purpose. Personal loans have a fixed rate and allow you to borrow up to a maximum of $100,000. Personal loans can be a great way to finance a variety of big-ticket expenses ranging from home improvements...

Read More

The Best Way to Pay Off Credit Card Debt

Posted on Jan 05, 2023 by Melissa Cook

Credit card debt has been a problem in America for a long time. The concept of card debt dates back to the early 20th century when charge cards were first introduced. These charge cards allowed consumers to borrow money from specific lending institutions and use that money to pay for...

Read More

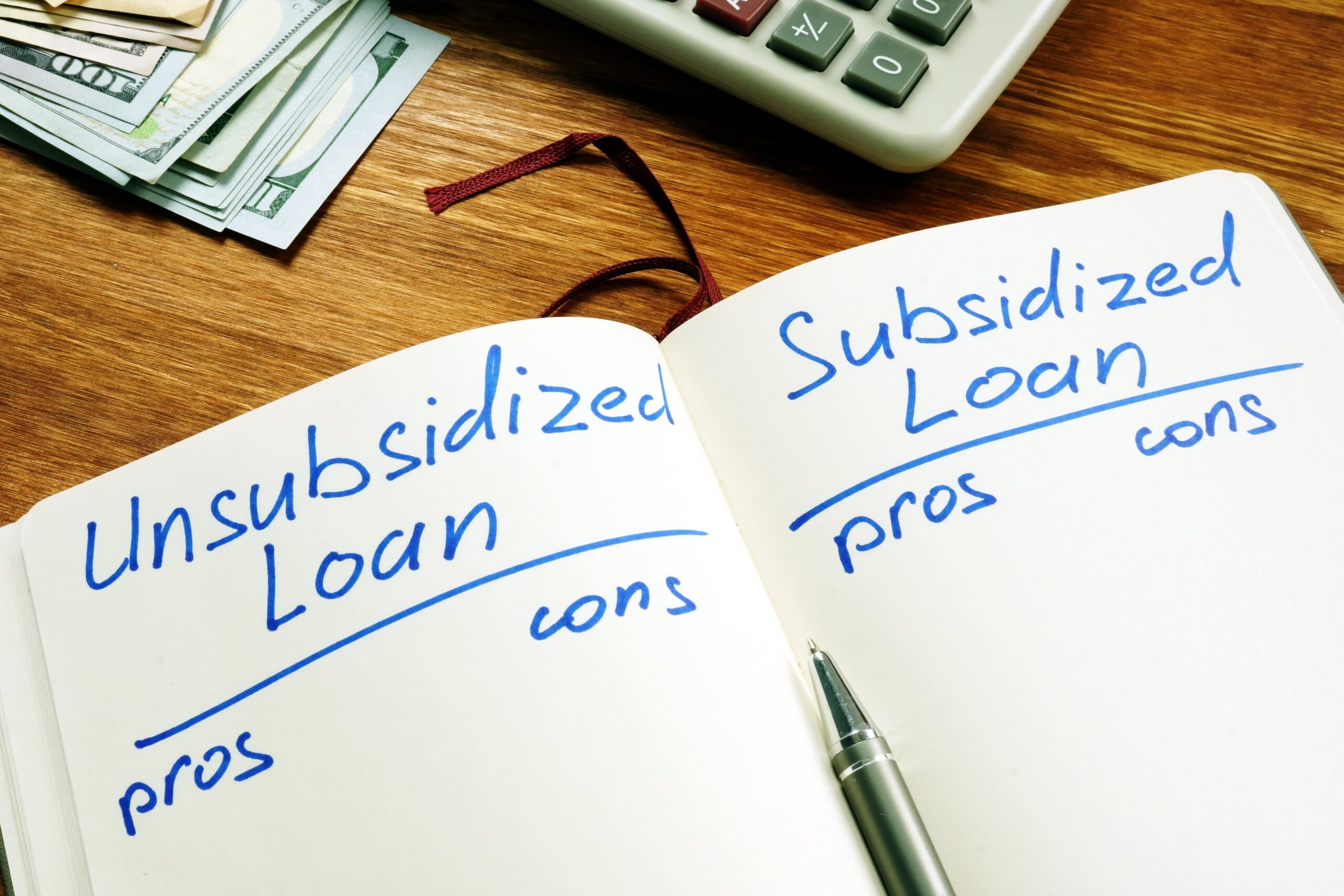

Subsidized vs. Unsubsidized Loans: What’s the Difference?

Posted on Jan 05, 2023 by Melissa Cook

If you’re considering taking out a loan for college or graduate school, read this first. Getting a loan can have a long-term impact on your financial journey and can sometimes result in debt. There are two types of student loans available: subsidized and unsubsidized. One loan is not necessarily better...

Read More

Check Your Credit Before Buying A Home

Posted on Nov 29, 2018 by Aaron Sarentino

Imagine that a friend asks to borrow money from you. Assuming you had the money to loan, you might then ask yourself, “Did he pay me back the last time he borrowed money? Did he pay me back the full amount? On time?” When you approach banks and lenders for...

Read More